Get This Report on Offshore Company Formation

Table of ContentsThe 10-Minute Rule for Offshore Company FormationThe 9-Minute Rule for Offshore Company FormationThe Main Principles Of Offshore Company Formation More About Offshore Company Formation

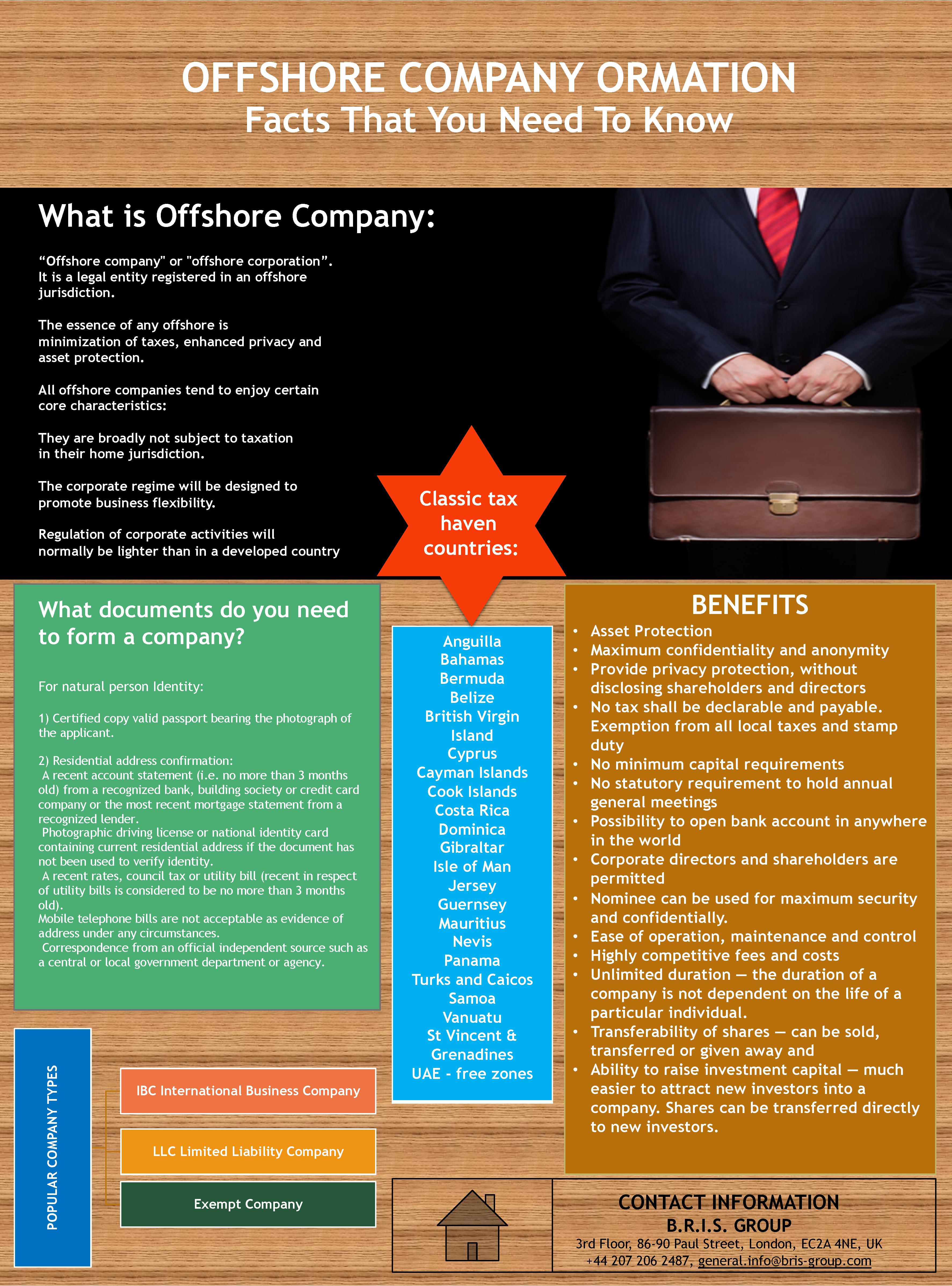

Given all these advantages, an offshore business formation in Dubai is the most ideal kind of enterprise if you are seeking to realise objectives and/or tasks such as any one of the following: Give expert services, working as a consultant, and/or work as a firm Resource international talent/ expatriate team Function as a Residential Or Commercial Property Owning & Investment firm International profession Restricted insurance policy Tax obligation exemption Nevertheless, offshore companies in UAE are not permitted to take part in the complying with service tasks: Finance Insurance policy and also Re-insurance Air travel Media Branch set up Any business task with onshore firms based in UAE Service Advantages Of A Dubai Offshore Firm Development Absolute privacy and also personal privacy; no disclosure of shareholders as well as accounts required 100 per cent complete ownership by a foreign national; no local enroller or companion called for 100 percent exception from corporate tax obligation for half a century; this choice is renewable 100 per cent exception from personal earnings tax 100 per cent exemption from import as well as re-export duties Defense and administration of assets Company operations can be executed on a worldwide level No limitations on foreign skill or staff members No restrictions on money and no exchange plans Office is not called for Capability to open and keep savings account in the UAE and also abroad Ability to billing local as well as international clients from UAE Unification can be completed in less than a week Financiers are not needed to appear prior to authority to assist in consolidation Vertex Global Consultants provides been experts offshore business arrangement services to assist international entrepreneurs, investors, and also corporations develop a neighborhood existence in the UAE.What are the readily available jurisdictions for an overseas company in Dubai as well as the UAE? In Dubai, presently, there is just one offshore jurisdiction readily available JAFZA offshore.

Additionally, physical presence within the nation can also assist us get all the documentation done without any kind of problems. What is the duration required to begin an offshore firm in the UAE? In an ideal scenario, establishing an overseas business can take anywhere in between 5 to 7 working days. It is to be noted that the registration for the very same can only be done with a registered agent.

Some Known Questions About Offshore Company Formation.

So the overseas business enrollment procedure have to be undertaken in total guidance of a company like us. The demand of going with offshore company enrollment procedure is essential prior to establishing a firm. As it is required to accomplish all the conditions after that one should refer to a correct association.

An is specified as a firm that is included in a territory that is aside from where the advantageous owner Get More Info stays. Simply put, an overseas business is merely a business that is included in a country overseas, in a foreign territory. An overseas business meaning, nonetheless, is not that easy and will certainly have differing definitions relying on the circumstances.

Indicators on Offshore Company Formation You Should Know

While an "onshore firm" refers to a domestic company that exists and functions within the borders of a nation, an offshore company in contrast is an entity that carries out every one of its purchases outside the boundaries where it is integrated. Because it is possessed and exists as a non-resident entity, it is not accountable to neighborhood taxation, as all of its monetary transactions are made outside the limits of the territory where it lies.

Firms that are formed in such offshore territories are non-resident because they do not carry out any type of monetary deals within their boundaries navigate here and are had by a non-resident. Developing an offshore firm outside the nation of one's own residence adds extra defense that is discovered just when a firm is included in a different legal system.

Since offshore firms are acknowledged as a separate lawful entity it runs as a different person, unique from its owners or supervisors. This separation of powers makes a distinction between the owners and also the business. Any kind of activities, debts, or liabilities handled by the business are not passed to its supervisors or participants.

Some Known Questions About Offshore Company Formation.

While there is no single standard by which to measure an offshore business in all offshore territories, there are a number of qualities as well as differences distinct to specific economic centres that are thought about to be offshore centres. As we have stated since an offshore company is a non-resident and also performs its deals abroad it is not bound by neighborhood corporate taxes in the nation that it is integrated.

Typical onshore nations such as the UK and also United States, generally viewed as onshore economic facilities really have offshore or non-resident business plans that permit international firms to include. These corporate structures additionally are able to be free from regional taxes also though ther are formed in a regular high tax onshore environment. offshore company formation.

To learn more on visit this web-site discovering the ideal nation to develop your offshore business go below. Individuals and firms choose to create an overseas company mostly for numerous factors. While there are distinctions in between each offshore jurisdictions, they have a tendency to have the adhering to resemblances: Among the most engaging factors to utilize an overseas entity is that when you use an offshore business framework it divides you from your organization in addition to assets and obligations.

Comments on “Offshore Company Formation for Beginners”